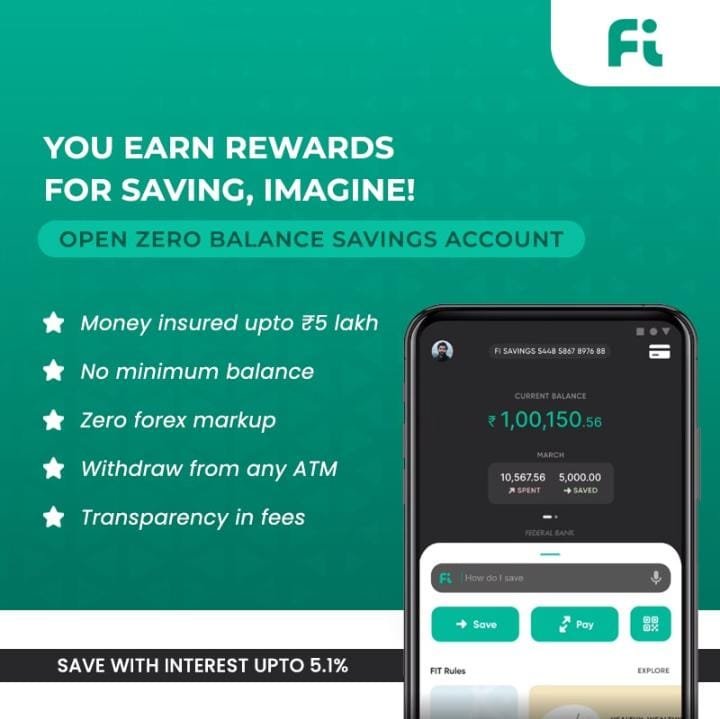

Fi Money Zero Balance Savings Account ( Partnership with Federal Bank)

The smart bank account for working professionals. Track spends, save, do more.

Open a Fi Savings Account online in under 5 mins! Use Fi’s cool features to get better with your money — track your expenses, organise your funds, maximise your savings & automate payments. You also get rewarded for saving🌟

Fi is a one-stop financial services app that comes with an in-built no-minimum-balance savings account! Some prefer calling it a ‘neobank’. Powered by cutting-edge tech, Fi helps you know your money, grow your money & organise your funds. It provides everything from hassle-free UPI Payments to a sleek VISA Debit Card with zero forex charges. Think of it as banking 2.0 for a generation of digital natives 👑

Why try Fi?

It’s an exciting alternative to complex traditional banking.

✓Money insured upto ₹5 lakh✨

✓No minimum balance🤘🏽

✓Zero forex markup 📈

✓No hidden fees ⚖️

✓Withdraw from any ATM 💳

✓24/7 Friendly customer support ☎️

🔥FEATURES🔥

Make sense of your money instantly

– Get all your personal finance questions answered by Ask Fi, your intuitive finance assistant 🔍

– Gain daily, weekly and monthly insights into your spends; judgement-free 😇

– Fi’s Smart Statements tell you just what you need to know, in plain English.

– With thoughtful and non-intrusive nudges, Fi encourages you to build better money habits 🌱

Get rewarded for saving money

– Introducing FIT Rules: Set fun rules that automatically save for you.

– The world rewards you for spending money; Fi rewards you for saving 🎅

– Use Fi regularly to make smart financial decisions – and earn rewards 🌟

– Besides curated offers, expect hyper-personalised rewards 🍹

– Money doesn’t grow on trees, but with Fi, you’ll discover the joy of growing ‘Money-Plants’ 🌱

You bank smarter, not harder

– Smart Deposit: A flexible way to save that’s designed around you and your goals 🏆

– Automate your payments: Create rules or set reminders as you go.

– Instant money transfers: Fi Protocol works out the best mode of transfer, and with zero transaction charges ⚡️

– Fi will auto-create a unique UPI ID for you! Just set a secure UPI PIN yourself, then send/receive cash immediately with BHIM UPI.

Safe & Secure

• RBI-governed partner bank hosts every Fi Savings Bank Account and Visa Debit Card.

• The funds in your account remain insured upto ₹5 lakh as per the Deposit Insurance Scheme.

• Fi Secure also gives you state-of-the-art internet security for your money and your data 🔐

You remain in control

– With Fi’s VISA Debit Card you can enable/disable swipe, online and contactless payments.

– Lost/misplaced your card? Tap to order a new one. Or freeze it in-app ❄️

– Fi’s saving rules: Lets you start saving money today and not wait for ‘tomorrow’.

– Your privacy is the top priority; there’s no sweeping data ‘under the rug’ at Fi.

How to Successfully Verify your Employment Details to Open Fi Account?

If You are Self Employed or Other you have to enter your Linkedin , fiverr URL to verify

If You are a Salaried Professional You have to enter Your Company Name to verify